Risk, Return, Impact

The Evolution towards Impact

While the growth in adoption of ESG and related approaches is positive, the bulk of that is driven by the objective of mitigating risks. To address the growing environmental and societal challenges as well as make progress on the SDGs, more focus is needed on actions and investments that seek measurable positive impact that results in increased well-being of stakeholders. Socially conscious investing is not a new phenomenon and has origins dating back several centuries (OECD, 2015). A number of decades ago, Socially Responsible Investing (SRI), a practice in which investors screen out companies with perceived negative products or practices, began to interest investors. A broader group of 'responsible' investors began seeking socially responsible and sustainable investments. Across the spectrum of capital - from philanthropists to investors – capital providers have increasingly begun taking impact into account as they consider allocations of resources. The traditional binary model of philanthropy (maximising social outcomes) versus investment (maximising financing outcomes) has evolved into a multi-dimensional one. Institutional investors have become increasing aware of the need to minimise risks while a growing subset of institutional investors is seeking to maximise impact. At the same time, philanthropists ranging from high-net-worth individuals to foundations have sought new models for leveraging the impact of the resources they bring to bear in addressing social and environmental challenges. A rising number of companies and investors are seeking to achieve positive impact. While for many, these efforts have focused on aligning existing activities and investments to the SDGs, for others, such as impact investors, it has meant investing to achieve greater impact alongside a financial return. This integrated approach has opened a broader dialogue about the intersection of risk, return and impact (Fig. 1.1) and amplified the 'imperative' to integrate impact into investment decision-making (OECD, 2019b). The increased focus on impact is driving a broader awareness of the need for transparency of relationship between risk, return and impact for all companies and investors, not just those proactively seeking a positive impact.

Collective Action

There has been a groundswell of efforts focused on inclusiveness and sustainability. The key is how to turn these efforts into global, coordinated actions that can make a positive difference in people's lives. The SDGs, created under the leadership of the United Nations and adopted in 2015, have provided a helpful framing for bringing the public and private sectors together to address global challenges. This is an important milestone as new approaches to environmental, social and economic challenges are needed which can provide more effective and/or efficient solutions. While the SDGs have led to unprecedented interest from the private sector, aligning with the SDGs is not enough. There need to be new approaches and initiatives, not just a repackaging of activities already being done. Also, to date, there is little accountability for SDGs claims and, in many cases, a lack of rigorous attempt to identify the relevant metrics and indicators by business.

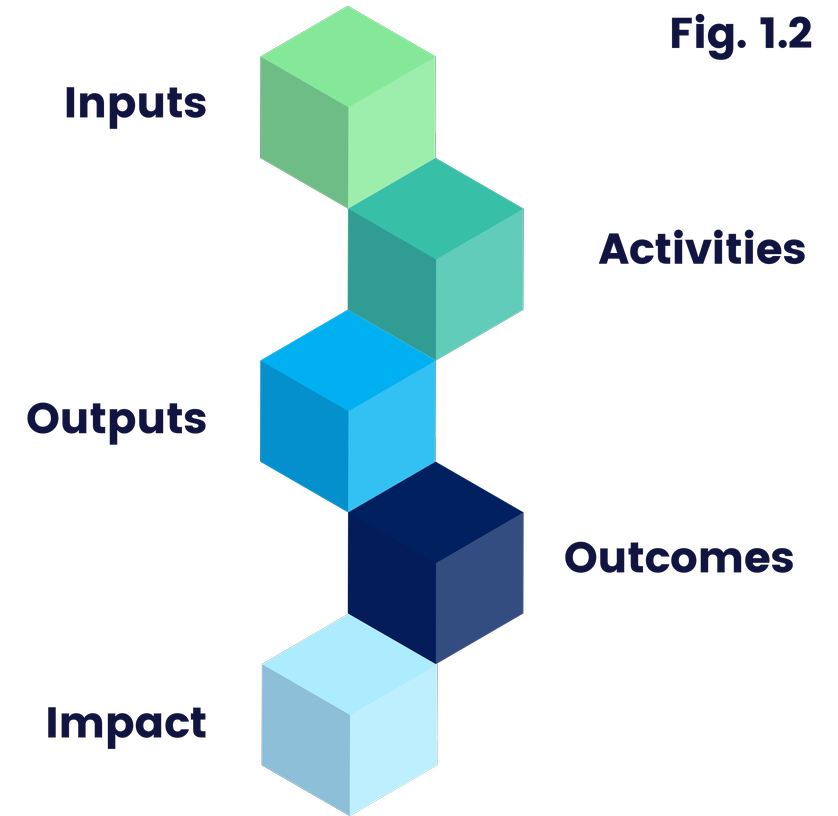

Many current impact measurement approaches still focus on measuring inputs, activities and outputs. To move towards the assessment of impact, outcomes must be measured and, where possible, attribution towards impact (Fig. 1.2). Private sector actors, including foundations, are stepping up to establish collaborative efforts to address pressing global challenges in innovative ways.